The challenges in managing the retail piece of an outdoor brand's sales strategy along with having its own robust e-Commerce presence continues. Having a presence on e-platforms like Amazon, Moosejaw, Sierra Trading Post, etc. are a basic piece of the puzzle. However, it's critical to have robust e-Commerce for outdoor products to sell direct. The number of manufacturers selling directly to consumers is expected to grow 71% this year, which means 2 out of every 5 manufacturers will be selling directly to consumers by the end of 2018.

You want to maintain and grow your general and specialty retailers, but you cannot lose sight of the reasons to have your own kickass e-Commerce platform. Amazon & their retailers are aggressively pursuing private labels. A fresh approach is required to maintain channel balance by giving consumers the convenience of online with the service of physical retail.

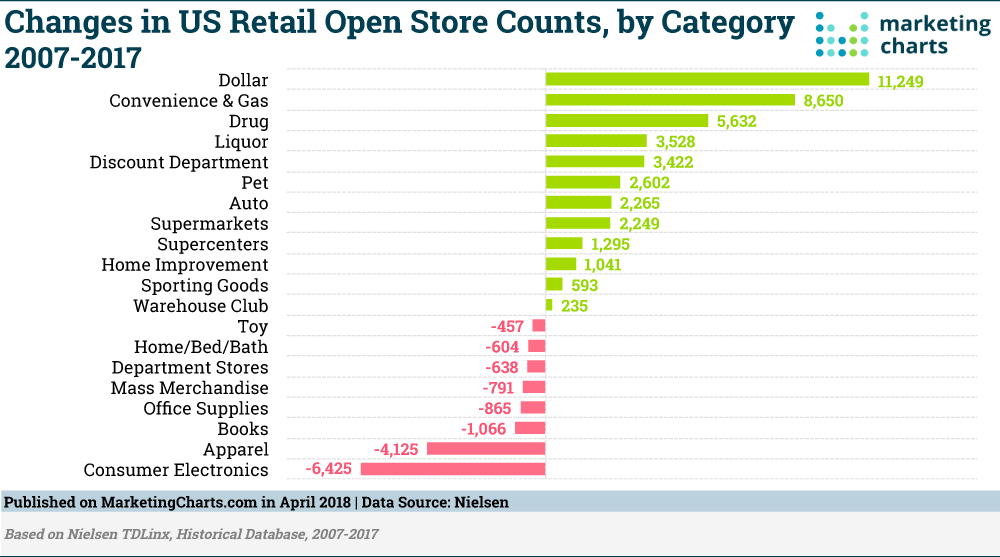

E-commerce – which was a $437 billion retail market in 2017 – has certainly upended the US retail landscape. But not all retail segments are surrendering to the so-called “retail apocalypse.” In fact, some are thriving, as seen in a recent report from Nielsen.

Here is a list of companies continuing to move the needle on how the shopping experience for consumers is going to change in this age of omnichannel consumer purchasing. You might also find our e-Commerce guide useful.

Amazon

Continues to grow its external prowess with consumers and sellers in the first quarter of this year, while enhancing internal systems and distribution capabilities. It is also now experimenting with retail store locations.

The Amazon.com juggernaut continued in the first quarter of 2018, as income and sales soared and its position as the most dynamic retail organization was further solidified. For the third year in a row, customers voted Amazon No. 1 in corporate reputation in the Harris Poll, U.S. consumers ranked Amazon top in the American Customer Satisfaction Index for the Internet Retail category for the eighth year in a row and LinkedIn recognized Amazon as the most desirable workplace in the U.S., among its accolades.

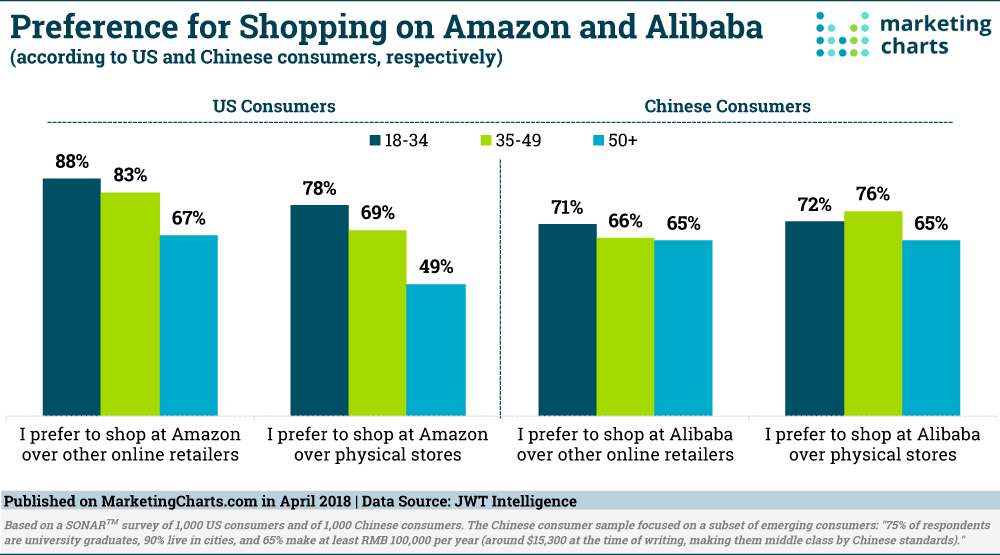

Fully 88% of 18-34-year-olds in the US prefer to shop on Amazon over other online retailers, finds JWT Intelligence in a survey conducted as part of its recently-released Amazon Everything report. Gen Xers are largely in agreement – 83% of 35-49-year-olds say they prefer shopping at Amazon over other online retailers. And not to be left behind, two-thirds of respondents ages 50 and older likewise prefer Amazon to other online retailers.

Fillogic

Fillogic was created on the belief that the future of brick-and-mortar retailer hinges on e-commerce. The startup wants to help retailers utilize their physical locations and existing assets, inventory and personnel to expedite last-mile logistics. Speaking at XRC Lab’s Cohort 5 Demo Day on Thursday, CEO and co-founder Bill Thayer said with his solution, stores could slash overall expedited shipping by as much as 60 percent, which he calls table stakes for today’s retailers.

In 2022, last-mile fulfillment costs are expected to reach $30 billion. A solution like Fillogic is designed to aid retailers trim $8 billion of fulfillment costs, said Thayer, who has held positions with Macy’s and Loehmann’s.

With access to 300 mall owners, Fillogic claims it can set up operations in just a few days for as low as $20,000.

Frenzy

Playing at the intersection of social and commerce, Frenzy offers automated commerce based on the visual exact match, taking the visual search game one step further than many of the solutions on the market today. Its platform enables influencers to turn their photos into “shoppable storefronts” but when a product is unavailable or sells out, Frenzy provides brand-specific alternatives rather than similar-looking items from any old brand, which helps strengthen the influencer-brand relationship.

Frenzy can achieve this largely due to the “explosion of influencer data that’s providing us billions of images that’s training our neural nets to make these connections between brands and SKUs,” CEO James Chang said. “We’re building a massive catalog of all of these data sources, but it’s a two-pronged approach because influencers and media site owners need to find more ways to monetize content as banner ads become antiquated.”

To date, 300 fashion influencers with a combined audience reach of 62 million monthly site impressions have installed the Frenzy API, achieving a 6x lift in sales conversions on product pages that amount to $8,000 in retail e-commerce sales in little more than four weeks, Chang said.

Viveat

Viveat joins a growing movement aiming to bring consumers closer to the products they own and love, making items more authentic, trackable and interactive. Today, product registration rates hover at 6 percent, and the Viveat platform offers what it claims is a seamless way for consumers to register goods. “Viveat assigns to products a unique digital identity called Product Passport and links to blockchain for proof of authenticity,” Marcello Gamberale Paoletti, CEO, said. The platform sits atop a company’s enterprise systems such as ERP and CRM to simplify content integration, and Gamberale said Viveat makes things like warranties and rewards management more interesting and accessible to consumers. The goal, he said, is to create more engaged customers, who typically are 1.7 times more valuable than those who are not. “It’s a very key opportunity for brands,” Gamberale said. Melissa Shoe will be deploying the solution across 700 of its U.S. stores, following several European brands that have generated $200,000 in revenue to date for Viveat.

Clark

When shopping in a store, consumers often see things they like—but then leave and can’t quite remember the brand name or other particulars. Clark wants to change all of that. Co-founded by Melissa Gonzalez, formerly of retail consultancy The Lionesque Group, the platform is a virtual multi-brand wish list for brick-and-mortar shopping, essentially helping customers keep track of the items they saw and liked in a physical store. The app-less approach stores each shopper’s wish list at a unique URL, accessible via a four-digit PIN. They can also opt in to be notified of product and sale alerts.

Clark’s goal, Gonzalez said, is to create a continuous communication loop across channels. “Our shoppers will enjoy the rich experience of physical discovery complemented by the conveniences of online shopping, and our retailers will gain insights that they can monetize just the way they do online today as we capture individual shopper journey, dwell times, product interest—and what we’re most excited about—purchase intent,” Gonzalez said. Such insights can aid retailers in executing smarter marketing and merchandising decisions.

ShipEarly

Online product selection with offline purchase is the favorite shopping method for multi-channel consumers. ShipEarly is helping shoppers find nearby places to experience and purchase products. With the retail and direct e-Commerce battleground being won and lost on the "consumer experience," ShipEarly helps give outdoor gear brands the opportunity for the best of online and offline shopping experiences. (Hear a great in-depth interview on this new service in Episode 37 of the Channel Mastery podcast series hosted by Kristin Carpenter Ogden)

As store closings occur, the retail brands within them are also impacted as they lose the ability for consumers to tangibly touch or feel products, the sales volume, and the ability for consumers to haphazardly discover their brand. Effectively managing both online and physical retail channels in a balanced approach is critical for success.

To achieve this balance, new ways to achieve channel loyalty and growth must be considered. The concept of Retail as a Service comes to mind where manufacturers can partner with their brick and mortar locations who can operate as a showroom, install, pickup, try-on, and return center, while also performing scheduled local deliveries to consumers homes for online sales. In this case, the retailer becomes a form of advertising for the branded manufacturer and makes service revenue on orders.

ShipEarly is providing an all-in-one channel management platform that allows for in-store pickup, ship to store, ship from store, ship to home, split cart options for the consumer. Improved online collaboration, rather than competing, can cement outdoor brands place at physical retail, making it easier for consumers to discover/buy online & off. A fresh approach is required to maintain channel balance by giving consumers the convenience of online with the service of physical retail. Check out our complete guide to e-Commerce services for outdoor products.