Revenue River is now an Instrumental Group Company. Learn more.

call us: 303-945-4341

Revenue River is now an Instrumental Group Company. Learn more.

Castle & Cooke Mortgage is one of the nation’s top mortgage lenders, with a long-standing commitment to helping families realize the dream of homeownership. They have a vast network of branches and loan officers across the US and are on track to expand even further in the coming years.

In early 2020, society was dealing with the COVID pandemic. Castle & Cooke Mortgage realized this was the time to prioritize their digital efforts, with the website being the central part of that. They came to us to discuss challenges and figure out a plan of attack.

Castle & Cooke Mortgage's previous website was built on WordPress and was cumbersome to manage. Performing updates required excess time, resources, and development support, and they knew there had to be a better way.

Additionally, their website couldn't support their need for dynamic data, and their network of loan officers listed on the site was out of date. Since loan officers form crucial relationships with buyers, this misinformation could seriously hurt their reputation. The listings relied heavily on iFrames from their Surefire operations system, which failed to pull in the correct data to keep the list up to date.

Ultimately, they needed a more connected platform that empowered their team to execute efficiently without extraneous administration and overhead. Plus, they needed their website data to be accurate and dynamic to build customer relationships.

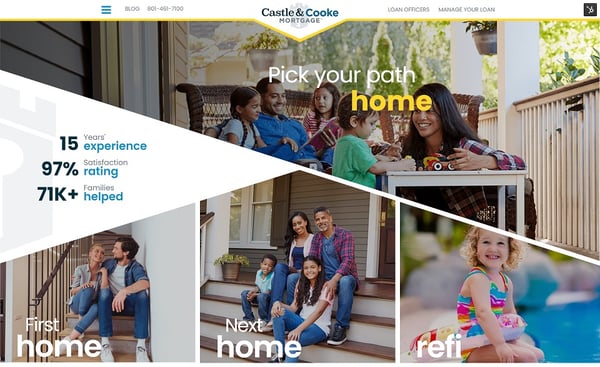

Old Site

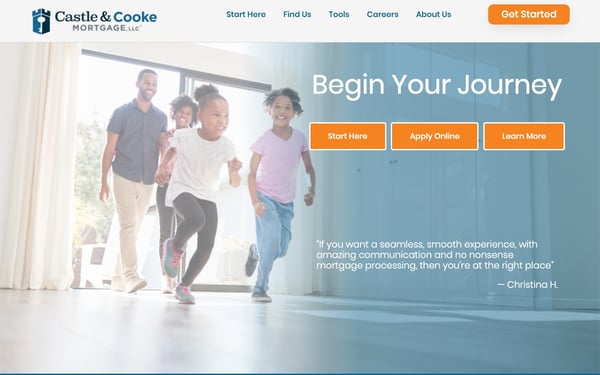

New Site

We were fortunate that Castle & Cooke Mortgage had some killer internal design and Subject Matter Expert (SME) resources that collaborated with us to produce an amazing finished product. The collaboration between our teams was a key factor in the success of this project.

The solution to address the goals of Castle & Cooke Mortgage was to re-platform onto HubSpot with a full ground-up redesign strategy.

We rebuilt the foundation on HubSpot knowing they would need to manage their website and also their network of branches and employees.

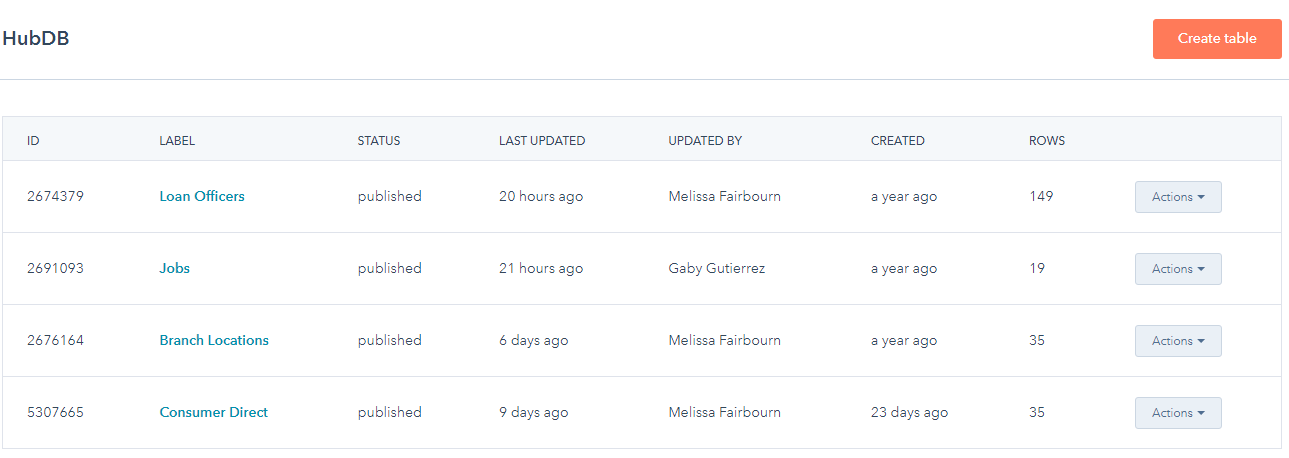

Our plan was to lean heavily on HubDB to store, filter, and display data dynamically on their website. Essentially, it centralized the management of the business. We created data tables covering loan officers, locations and branches, and even careers.

In doing so, we made it easy for their team to update information in just one place, without needing to manually update any pages.

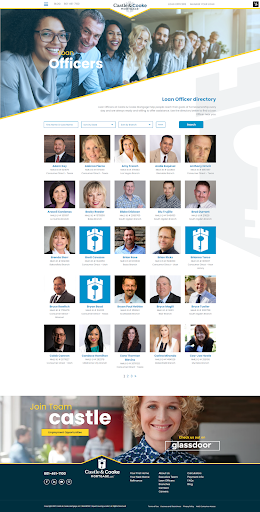

Our strategy was to connect the user with an actual person who could help them in their area as quickly as possible. To do this we started streamlining the navigation menu and prioritized the loan officer directory page up top. This page is dynamically populated from a dedicated HubDB table of loan officers. We’ve provided easy filtering ability and general name search to make it as easy as possible for borrowers to find a specific person, or easily see who is relevant to them.

Our strategy was to connect the user with an actual person who could help them in their area as quickly as possible. To do this we started streamlining the navigation menu and prioritized the loan officer directory page up top. This page is dynamically populated from a dedicated HubDB table of loan officers. We’ve provided easy filtering ability and general name search to make it as easy as possible for borrowers to find a specific person, or easily see who is relevant to them.

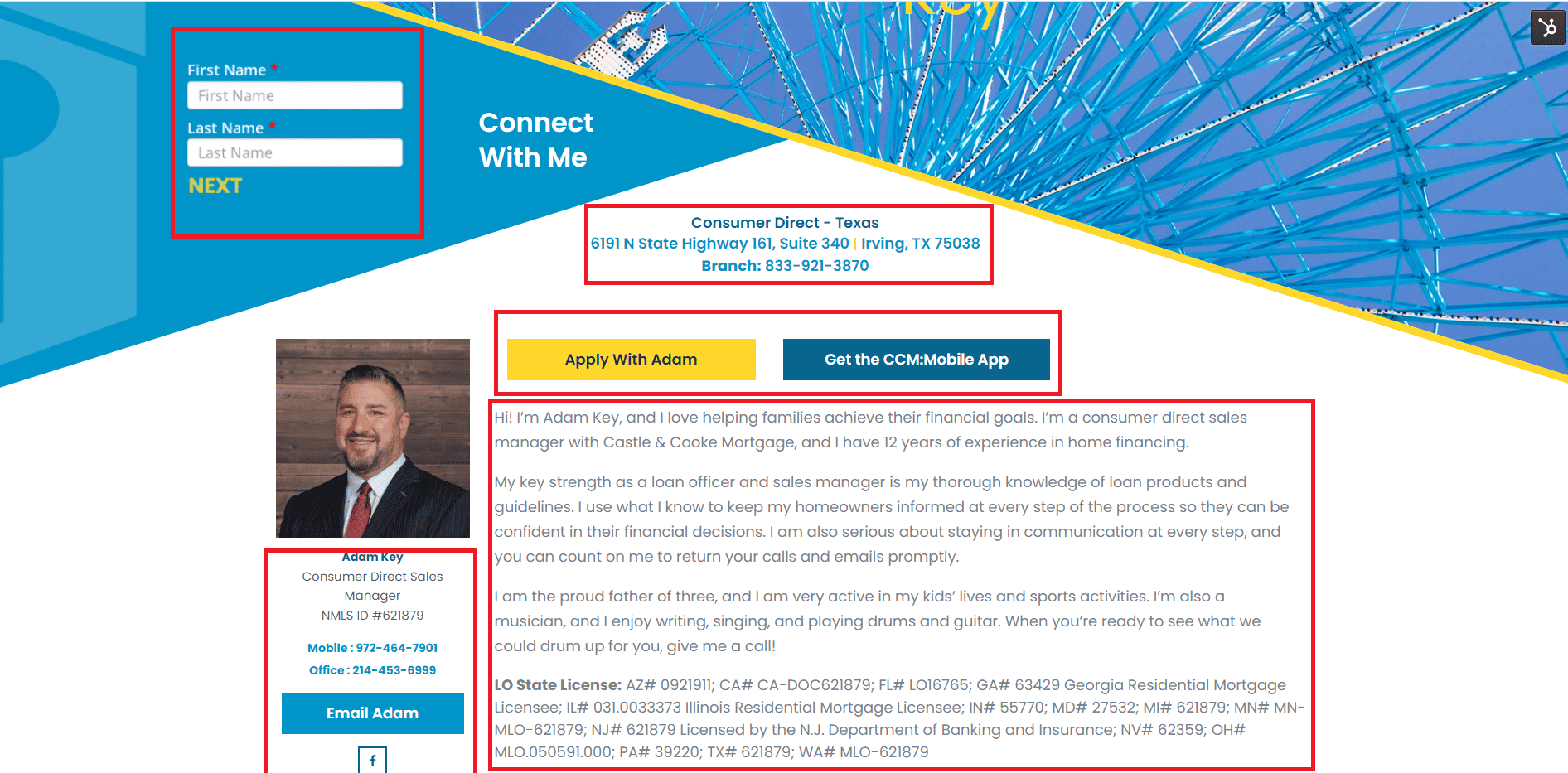

With click-throughs to the individual loan officer bio page, we again were able to feed all data from a dedicated HubDB table. All contact info, bio, branch, and CTA buttons are managed in the database, and that alleviates any need to make content edits at the page level. With integrations between the site and their experience.com review system, as well as their Surefire operations system, we’re able to expand on the information provided without additional management and seamlessly integrate with their existing business operations systems.

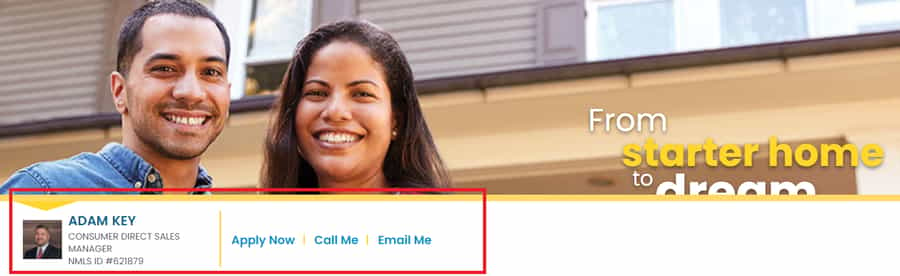

To take it a step further, we wanted to enhance the personalization of the site. To achieve this, we leveraged a browser cookie that is installed after the user visits a loan officer page. When they navigate to another page on the site, the browser will display a sticky footer with loan officer information and specific conversion points. All conversions tracked through their contact record in Marketing Hub.

Visiting another loan officer page will update the cookie so the last visited loan officer will be the one that displays on the footer. This achieved our goal of connecting people with people as seamlessly as possible and made it easier for customers to find the loan officer they were working with previously.

For users who don’t know which individual they should work with, we created a national branch directory of locations. Here users could drill down by their particular state. Because we didn’t have a brick and mortar location in every state, we developed a custom HubSpot form to display dynamically for any state that didn’t have a location page. Here we were still able to capture lead data and route to the national account team instead of turning away a potential opportunity.

For users who don’t know which individual they should work with, we created a national branch directory of locations. Here users could drill down by their particular state. Because we didn’t have a brick and mortar location in every state, we developed a custom HubSpot form to display dynamically for any state that didn’t have a location page. Here we were still able to capture lead data and route to the national account team instead of turning away a potential opportunity.

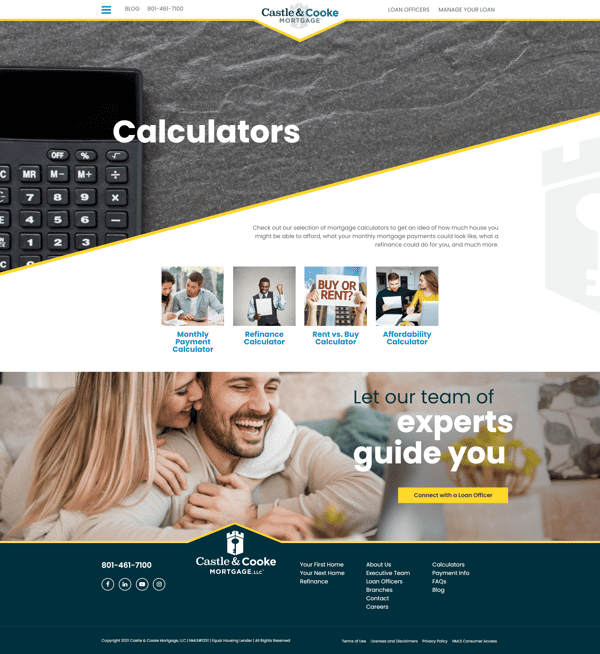

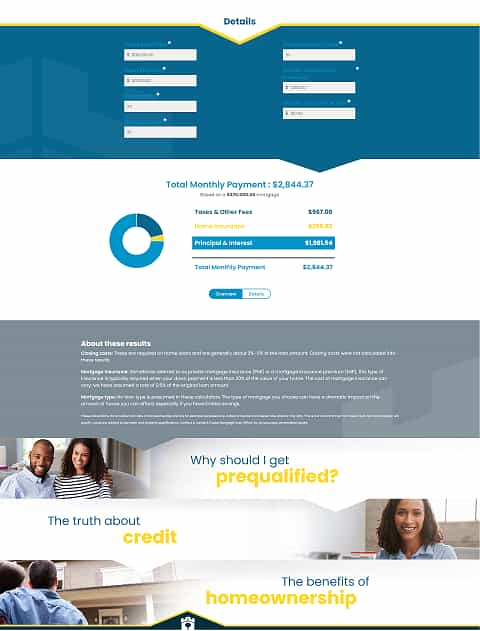

To top it off, we included 4 custom built calculators to provide several premium content offers to drive leads and further engage potential borrowers. We elected to un-gate these offers and display results directly on the page, with optional on page form, and strategic click trough's below, to give users next steps specific to the calculator they’re leveraging

Main calculator listing page that links through to four individual pricing calculators targeted at specific personas. All custom built using HubSpot.

Our calculators are some of the best performing pages on the site driving a total of 144 new contacts YTD. With time on page upwards of 2min for each, we’ll continue to look to these tools for ongoing lead generation through the site.

This year to date, we have seen positive effects across various business units. In terms of HR and talent acquisition, we were able to successfully intake and process over 310 career submissions YTD as of December 8, 2021. 75% of these submissions were new contacts and were able to be qualified and tracked internally as non marketing contacts in the HubSpot CRM.

Additionally, our approach at a tiered system with national directory, state pages and individual LO’s seemed to resonate with users. Our non-location branch directory form had collected 117 submissions YTD which allowed the national accounts team to not only engage these opportunities, but help plan for priority market expansion going into next year.

Lastly, even with the challenges posed by the COVID pandemic, our approach at leaning into digital more, directly translated to helping individual loan officers. Through HubSpot forms reporting, we can see how many individual applications were submitted through each LO.

Our loan applications go through a third party site. For privacy reasons, we don’t have stats on how many applications have come through connected to the links on our website. However, of the “connect with me” forms we have on the branch and LO pages that connect to our CRM, there have been 199 submissions on the branch form and 1009 submissions on the LO form since launch.

The impact of the redesign positioned Castle & Cooke Mortgage with not only a great looking site that was modern in aesthetic, but streamlined and hyper focused on the user experience. We were able to serve business processes through HR support with talent acquisition, loan officer enablement with digital tools to support their sales cycle, and a digital foundation, built on HubSpot Themes, that freed up time for their sales and marketing team to work more efficiently, without the additional overhead of trying to manage a cobbled system.

Looking forward, now that the machine has been built, we aim to optimize and automate it further to increase engagement of abandoned applications and increase overall qualified traffic to the site to fill the pipeline. With the framework in place for scalability, we’ll be able to easily add staff and locations nationally on the fly for years to come.

As a web developer I’m aware of how messy site management can be. I’ve appreciated the utilization of HubDB tables and modules to simplify regular site maintenance. The usage of dynamic fields and HubDB makes regular page creation quicker and cleaner for our growing list of loan officer pages. The modules and templates that were developed allow me to more easily create custom pages for various projects.